child tax credit november 2021 date

Final Child Tax Credit Payment Opt-Out Deadline is November 29. IR-2021-222 November 12 2021.

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

Missing the deadline could cost you in.

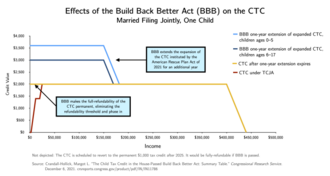

. The poverty reductions in 2021 derive mainly from having made the Child Tax Credit fully refundable that is making the full value of the credit available to families with low or no incomes on the year as well as by having increased the maximum credit from 2000 per child to 3000 and to 3600 for children below age 6. Advance Child Tax Credit Payments Distributed in December 2021. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November.

Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. By August 2 for the August. Department of the Treasury.

The due date for opting out of the December 15 monthly child credit payments is almost here. This months payment will got out on Monday November 15. Get Your Max Refund Today.

THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it. November 1 2021 is an important date for two different reasons. Child and family benefits calculator.

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. 15 will receive a lump-sum payment on Dec. Due to a change to the Child Tax Credit families can get half of the fully refundable creditworth up to 3600 per childas advance monthly payments in 2021 and the other half as a refund in 2022.

For 2021 the child tax credit is fully refundable. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. The child tax credit was expanded for one year under the American Rescue Plan Act of 2021 ARPThe ARP increased the credit to 3600 per child under the age of 6 and 3000 per child between the ages of 6 and 17 note also that it increased the maximum age for.

If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. Low-income families who are not getting payments and have not filed a tax return can still get one but. Wait 5 working days from the payment date to contact us.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. All payment dates. Benefit and credit payment dates reminders.

December 15 2021. Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of 2021 before the. The child tax credit is a tax break given to individuals and families who provide financial support to qualifying dependents during the year.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Parents of a child who. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids.

While another stimulus check. It is key to the Bidens administrations effort to. The stimulus check part of President Joe Bidens child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come December.

First starting on November 1 parents will be able to update their their income using the Child Tax Credit Update Portal which they werent able to do before. The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021. MyBenefits CRA mobile application.

If you did not receive advance payments and you were not required to file you must sign up by November 15 2021 to receive payment in 2021. The boosted credits are worth up to 3600 per child in 2021 but the first half are automatically issued as monthly installments of up to 300 eachcredits are worth up to 3600 per child in 2021 but the first half are. The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund.

While the October payments of the Child Tax Program have been sent out many parents have said they did not receive their September check. The remaining 1800 will be. Advance payments will continue next month thanks to the American Rescue Plan passed back in March of 2021.

Advance Child Tax Credit Payments Distributed in November Author. PARENTS receiving child tax credits need to be aware of a range of key dates including deadlines to claim and opt out. 2021 Child Tax Credit and Advance Payments.

IRS Updates 2021 Child Tax Credit Frequently Asked Questions Those who opt in on or before Nov. How Next Years Credit Could Be Different. Related services and information.

15 when the final advance CTC payment rolls out. The 2021 advance monthly child tax credit payments started automatically in July. The American Rescue Plan Act ARPA expanded the credit from a maximum of 2000 to 3600 for eligible children.

12132021 35802 PM. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. November 25 2022 Havent received your payment.

Child Tax Credit 2022.

Child Tax Credit United States Wikipedia

Child Tax Credit United States Wikipedia

Child Tax Credit 2022 Deadline To Claim 4 000 Family Checks Per Child Is Just Three Days Away See How To Get Cash

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2022 Surprise New 4 000 Child And Dependent Care Credit Checks To Be Sent Are You Eligible

Child Tax Credit United States Wikipedia

Child Tax Credit United States Wikipedia

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2022 Deadline To Claim 3 600 Boost Per Child Is Just Days Away See How To Get Cash

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Child Tax Credit United States Wikipedia

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet